Overview

Davivienda is a Colombian bank that is part of the Empresarial Bolivar Group, which has helped people, families, and companies meet their objectives for more than 75 years.

Recognized for their unique management style which is achieved through effective communication, they are one of the five most valuable brands in Colombia and the first bank to receive public recognition in the country.

Davivienda has more than 17,000 employees, serving more than 10 million customers in 725 offices, and has around 2,600 ATMs across the region. In addition to its headquarters in Colombia, Davivienda has offices in Panama, Costa Rica, Honduras, El Salvador, and Miami in the United States.

The Challenge

Due to the pandemic, the entire banking sector had to find ways to maintain contact with its customers and make them feel the peace of mind that is needed in such a complicated process.

Clients wanted to stay informed about their finances, investments, and savings, but due to global government regulations, attending an agency was virtually impossible. In the specific case of Honduras, the restrictions were quite strong, with rules that allowed citizens to leave their homes only twice a month, though many used these opportunities to buy food and basic necessities. With such strong limitations and lockdowns in place, many organizations were having to completely rethink their customer service strategy.

Considering these limitations, Davivienda Honduras identified 3 main challenges that they needed to solve in order to continue providing their service in the most accessible way possible:

- How can we maintain a close relationship with the customer?

- How can we bring commercial offers to the clients’ homes without physical contact?

- How can we get executives to keep our customers’ attention without seeing them in an office and compromising their health?

The Solution

Thanks to the culture of innovation that characterizes the Davivienda group worldwide, and to understand that it was necessary to accelerate the digital transformation of the brand in Honduras, Davivienda was able to understand the challenges of the situation and open up to new possibilities- possibilities that, thanks to previous work with ACF Technologies, they already knew and decided to apply.

Davivienda Honduras began to change the service paradigm of its staff towards one focused on technology. This would allow clients to carry out their interactions with the bank without leaving their homes, thus receiving the same quality of service and support to build their dreams, with all of it being based on our Assistant Anywhere service.

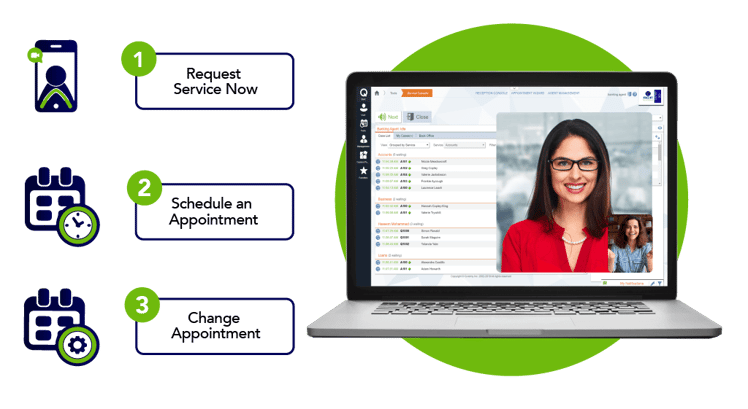

The service is accessible to all clients and users from any device with an internet connection on the official website of Davivienda Honduras, offering the possibility of choosing between 3 modules:

- Talk to a virtual executive as soon as possible: This option allows business service inquiries and places clients in a virtual queue to wait for the next available advisor.

- Schedule a virtual appointment: In this option, the customer decides when and what time they want to be attended by the customer service team and they have the option of receiving advice on more in-depth products compared to option one.

- Modify a virtual appointment: In this module, the client will be able to consult or modify a scheduled appointment and they will only need their identification number to access their request history.

In any of the options that the client chooses, they will receive reminders and confirmations through text messages and email. At the time of the appointment, they receive a text message with the link and the security PIN to access the video call with the assigned Virtual Executive, without the need to download special software or an application in the case of mobile phones.

The Results:

- Clients did not face any interruption with access to services such as consumer loans, drafts, housing, and insurance of all kinds

- Clients of the SME segment were able to access specialized advice from employees

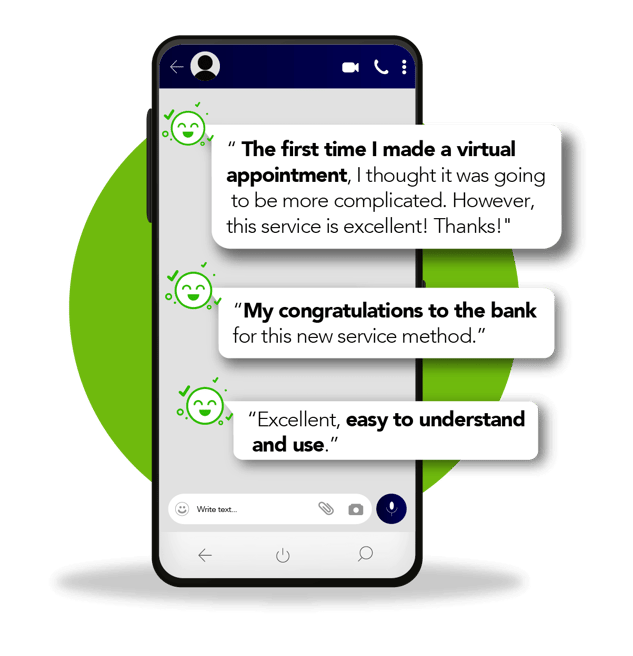

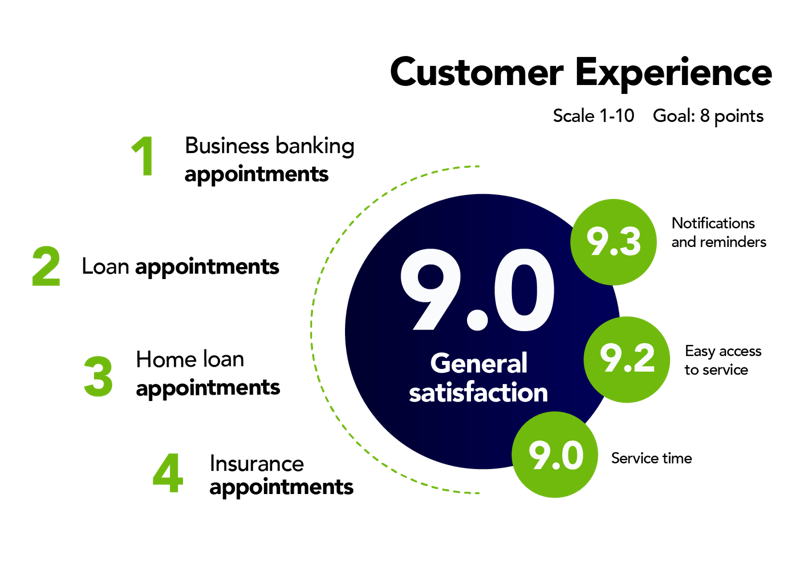

- Customers gave an overall rating of service satisfaction 9pts, which averaged as follows: communication and reminders: 9.3pts, ease of accessing the service: 9.2pts, service times: 9pts. All of this is on a scale of 1 to 10 and thus they exceeded the goal set by the bank of 8pts

- This feedback was obtained thanks to the online survey service that Davivienda Honduras had integrated into the ACF Technologies platform

- Davivienda Honduras exhibited this project at the regional level among the other subsidiaries and was recognized at the 2020 Internal Service Achievement Ceremony

Thanks to the success of "Virtual Executive", Davivienda Honduras was able to demonstrate to its clients how valuable they are as a brand. If you want to know more, don't miss our webinar here.