Financial services clientele are often customers who are specifically searching for your products and services and are therefore high in engagement. Hence, making a 1-on-1, personal impression is especially important. Though, offering seamless customer experiences can be difficult when working with outdated banking processes that often involve checks, branches, and large amounts of paperwork.

Despite this, many financial businesses still use inefficient, time-consuming, and unpredictable sourcing and payment practices despite numerous opportunities to upgrade technology. Doing so wastes valuable human resources that could be better allocated to business growth. As a result, financial institutions continue to miss out on potential clients and should be encouraged to automate some of their financial processes.

The Needs and Wants of Financial Customers

Consumers are looking for everything in terms of financial services: in-person assistance when needed, as well as convenience from digital and mobile channels that offer self-service on-demand. In other words, you could say that they are difficult to please. Financial institutions can provide consumers with the personal attention they need while also providing them with the self-service capabilities they desire by appropriately evolving and automating branches.

How To Automate Financial Services and Remove Friction

Leverage the right tools and strategy

Identifying and implementing branch evolution and automation strategies can enhance your brand and be a key driver for growth and success. Wondering what the right tools are to help achieve this? Let's explore the options.

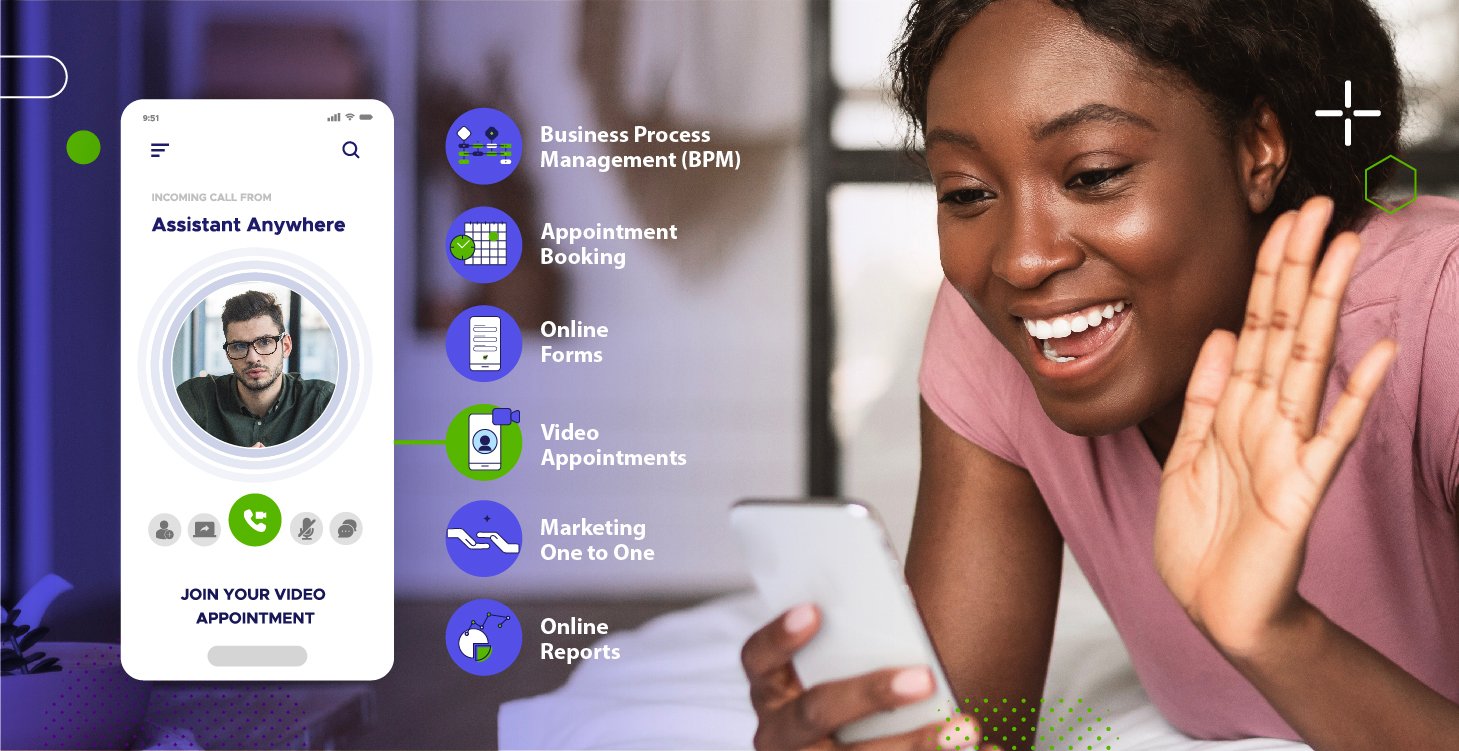

1. Business Process Management (BPM)

The goal of business process management (BPM) tools is to improve performance within an organization. The purpose of these systems is to manage and optimize a company's business processes systematically and logically. The BPM tools help companies design, model, implement, and measure workflows and business rules, helping them refine and optimize processes that involve human interaction or multiple business applications and remove the friction of difficult or otherwise pointless operations. Business process management can reduce inefficiencies, human errors, or miscommunications. A good example of this is banking workflow automation in customer service. Banks are typically involved in various situations, including account inquiries, loan processing, credit card inquiries, etc. The workflow automation process resolves low-priority queries on its own, allowing the customer service team to focus on more important issues. The system is able to compare and verify data in the bank with that of the customer on the phone. Customer service automation plays a vital role in reducing waiting periods and improving customer relationships due to prompt solutions.

The Business Process Management Software we offer enables you to orchestrate processes across multiple information systems using tools such as task management and BPM communication.

With BPM, you'll be able to manage complex service processes that integrate customer flow optimization and back-office automation. Our software provides project management, automated workflows, and repetitive processes to handle all aspects of your day-to-day business and administrative tasks.

As a result of the solution, systems are linked, employees are involved, and customers are engaged. It streamlines workflow, enforces business rules, and ensures unresolved cases are not forgotten, and goals and KPIs are monitored with reports and alerts.

2. Appointment Booking

An essential component of digital banking services is online appointment bookings. It is far more efficient to book advisory or transactional services digitally, regardless of whether your bank sells products online or not.

Large numbers of customers are common in financial institutions, which makes them harder to handle. Banks and credit unions often need to hire staff to cover peak hours determined by historical trends. This can lead to an unpredictable stream of customers, each with different needs.

Online booking platforms simplify the booking process and eliminate the guesswork from the game. Not only can banks and credit unions predict when customers will arrive, but also who will arrive, for what service, and for how long. This gives them valuable information about their customers to plan better for the future.

Appointments also give customers a sense of accountability and make them feel heard and listened to. After all, having a scheduled appointment is significantly more meaningful than waiting in a call queue for hours.

Besides benefitting your customers, automating your booking system can also help your staff members and productivity.

The use of online appointment booking eliminates the possibility of human error and double bookings – which ultimately can increase business, capture market gaps and provide a bespoke customer experience for your customers.

Q-Flow – our industry-leading appointment scheduling software, combined with a BPM solution, ensures that systems operate more efficiently and allows employees more time to address the customer's needs. Further, the customer experience is improved by giving them control of their time when booking and managing their appointments through a smart appointment management solution.

At ACF, we understand the need for financial institutions to provide customers with effective and seamless services. With our Q-Flow® platform, you can achieve these goals while improving internal processes for a better customer experience.

3. Online Forms

A concerning number of Banking and Financial Services organizations still have many revenue-focused processes such as credit card, personal loan, and home loan application forms in old, static formats or on paper forms, creating friction and barriers for customers to transact.

Online forms can transform static forms into adaptive data-driven applications that capture information from any device, thus improving the overall customer experience. Online forms also offer significant benefits to financial organizations with field operations, including eliminating paper, processing information more quickly, and reducing re-keying.

Simple to design and easy to complete, our ACF intuitive online forms are easy for your staff and your customers to use. Based on the customer's answers, they can fork into different flows based on the prompts and put processes on hold until the form is filled out correctly.

Customer feedback and records collected via our online forms can seamlessly integrate with your existing databases, enabling employees and customers to receive appointments and data faster and more efficiently.

We offer a wide range of useful features in our digital forms, including:

- Easy form software

- Completely branded forms

- Pre-service data collection

- Document uploading

- Online feedback system

- Online survey analytics

- Multilingual forms are fully supported

- E-signature collection & authentication

- Easily re-purpose collected data via forms by downloading the pdf

4. Video Appointments

Considering traffic to mobile banking apps went up 85% in April 2020, and 40% of Americans say that they will not be returning to physical banks after the pandemic is over, it is no surprise that video banking has taken off. In Europe, a whopping 74% of citizens are now relying on mobile banking apps to manage their finances.

A video banking service is essentially any kind of banking service that offers video representations to help customers. A major contributing factor to this is the development of new technologies, such as machine learning. As AI programs learn from their interactions with customers over time, they use machine learning to train against themselves and improve their performance.

The importance of other channels and video banking

Video calling and teleconferencing saved our socio-economic fabric during the pandemic when people had to stay at home and find new ways of communicating, conducting business, and managing finances. Currently, video conferencing platforms are out in full force, and almost every commercial sector uses video conferencing for the convenience it provides.

Video banking has improved the mobility of bank managers - they no longer need to be in the office all the time to do their jobs. The traditional office hours may now be switched to an employee-set schedule, so they don't have to worry about being late to work. Customers can call from home or on the go.

Many banks now offer online services that enable customers to check their account balance or transaction history without ever visiting a branch. With direct deposits, automatic bill payments, and mobile payment apps, consumers can often handle their transactions without traveling to a bank branch or contacting a representative. For both your organization and the customer, web and mobile banking, chatbots, telebanking, and even social media will often win out in these situations in terms of both time and money saved.

This is something we can help with!

Our Assistant Anywhere solution, built on the Q-Flow® platform, allows customers and clients to schedule consultations and appointments remotely via video chat, wherever and whenever they want. Inconvenient and uncomfortable lobby waits are a thing of the past with Assistant Anywhere. A virtual waiting room will be enabled for your customers in which you can notify them shortly before their scheduled appointment through an end-to-end encrypted communication channel.

Our video appointment solution gives your customers the real-time experience they’ve been looking for.

5. Marketing One to One

Increasing new accounts is crucial to the success of any bank or credit union. Though, the cost of acquiring new customers organically can be extremely high. In many cases, their existing customer base offers the best potential for short-term revenue growth. Often, selling additional products to existing customers is more effective, more efficient, and more profitable.

Having an existing customer convert to an additional offering has a higher chance of success than targeting cold leads. Banks can generate a 70% return on initiatives targeted at existing customers versus 10% for new customers. “In a time where every bank is focused on revenue growth in a constrained and competitive environment, making smart choices with limited resources can provide a fast track to higher-margin growth,” PwC states.

Marketing personalization across channels

Retail companies with digital maturity leverage multiple channels to create bespoke customer journeys, utilizing cross-channel marketing and personalization. Taking into account that the most successful channel combinations involve human touchpoints, banks should adopt and adapt these methods.

Digital marketing can boost revenue significantly. Data analytics engines can track customer clicks and time spent on web pages. Based on that data, messages can be personalized. Customer behavior online can be a clear signal of With the ability to track these signals, banks can quickly make the right offer based on customer interest.

Here at ACF, we can help you create a customized loyalty program for your marketing solutions.

We have developed software that can identify frequent customers and detect specific sales opportunities, giving priority to sales opportunities that are high in value. With ACF you can organize all screen advertising and interaction devices inside your branch or store to strengthen your closeout opportunities.

6. Online Reports

Reporting is pivotal for the success of a business, especially for those in the finance sector.

Automating reporting has reduced overhead costs and allowed staff to focus on higher-value tasks. This allows Branch Managers to focus on client meetings and capturing potential revenue opportunities rather than analyzing and interpreting complex reports. Therefore, clerical errors and misinterpretations are eliminated through online reports.

Executives at all levels in today’s business landscape also realize that in order to make confident decisions for their company’s future and customer experience, they need powerful reporting tools. After all, it enables them to rely on solid data and insights about their key performance indicators (KPIs).

ACF combines two solutions to deliver business-empowering data insights, Q-Flow Info Center and Q-Flow Insight Data Cube. Combining both solutions offers key features such as:

- Real-time performance reporting, dashboard views of stores, departments, and agents

- Easy performance evaluation over exact periods

- Bi-level reports examining data at the most granular level

- Advanced analytics for better targeting

Our online reports solutions also help with advanced analytics.

By applying advanced analytics to customer transactions and digital banking, omnichannel sales can be more effective. The use of analytics allows banks to better understand customer segments and behaviors and tailor products and value propositions accordingly. As much as 40 percent of sales productivity can be increased.

Find the Balance Between Technology Innovations and Human Needs in Automation

Whenever you hear the word "innovation," it's easy to get swept up in the fantasy that it's all about flying cars and brain implants. However, the innovation that truly impacts the world today is simpler than that and is rooted in the basic principle of improving the user's experience of products and services.

In the next decade, banks will be able to offer customers hyper-personalized, automated services, replacing the traditional retail product-based approach. A bank's ability to find the right balance between innovation and risk management will determine the future of banking.

Despite the potential of automation and AI, the personal touch in customer communications is still essential for many companies. While automation can be powerful, that should not completely disappear. Traditional telephone calls and face-to-face meetings are effective ways to satisfy your clients.

In conclusion, implementing automation in financial institutions offers many benefits and endless opportunities. Through automation, digital transformation of financial services can be enabled, allowing buyers and suppliers to connect with streamlined financial services capabilities and removing any friction.

We can help you if your organization is in a pivotal stage and needs processes and technological solutions.

Call us or request a demo today if you are interested.